You can't predict the weather

From scorching hot summers to winter cold snaps, one thing noticeable is the increasingly erratic nature of weather patterns. From an infrastructure standpoint, this is especially clear in various aspects of electricity use – from customer affordability to reliability, and to the extent of when we decide to flick the switch. While we see a structural transition in energy is underway as renewable energy continues to gain penetration, there are nonetheless significant hurdles to clear in the coming years. For electricity system operators, utilities and energy infrastructure providers, building a reliable, resilient system is a substantial process.

The hum of the heater against a winter chill is one of many demands drawing on power networks. Data centres and uptake of AI, as well as the electrification of industry and vehicles are increasing demand for electricity. Concurrently, it’s also putting tremendous strain on the grid. The use of ageing infrastructure to meet these demands is an added challenge. Blackouts, such as the major event in Spain this year and South Australia in 2016, are clear examples of where these increasing strains reach a breaking point.

At the same time, weather patterns are more extreme. According to the Australian Bureau of Meteorology (BOM), there is a significant warming trend in the Australian climate, with Australia’s average temperature increasing by 1.47 degrees Celsius since 1910. This warming is accompanied by changes in rainfall patterns, increased fire danger, and rising sea levels. Looking ahead, the BOM expects a continued increase in air temperatures, with a skew towards more heat extremes (and fewer cold extremes). The same pattern has been observed globally, with national agencies in the US, UK, Europe and elsewhere experiencing similar trends.

More extreme weather drives sharper peak demand for electricity. For example, in Australia, recent cold winter temperatures have driven spikes in demand for power, and accordingly pricing. The state of Victoria recorded a peak spot price ($/MWh) of $2,7251 on 12 June 2025, well above the prior daily peaks of -$40 to $200 recorded this year. This event is notable because the June 2025 peak price coincided with minimum temperatures reaching monthly lows of 3.6 degrees Celsius in Melbourne. With the solar energy production weak, light winds and some coal-fired generation down, the state had little choice but to use more than 13% of its expected gas for energy generation for the entire year over a three-day period in June. This episode is important to call out, as the surge in spot pricing showed that in an energy system characterised by ageing fossil fuel generation – in the form of coal and gas – and increasing penetration of renewables, very few things in the system can go wrong if we are to avoid such spikes.

This example highlights a common challenge for electricity grids in many jurisdictions; providing sufficient baseload generation (e.g. gas-fired) while transitioning to renewable or lower-carbon fuels is a tricky balance to strike. Regulators and system operators must manage the intermittency challenges of renewables to avert system shortages – and keep the lights on – while allowing for the integration of more renewables.

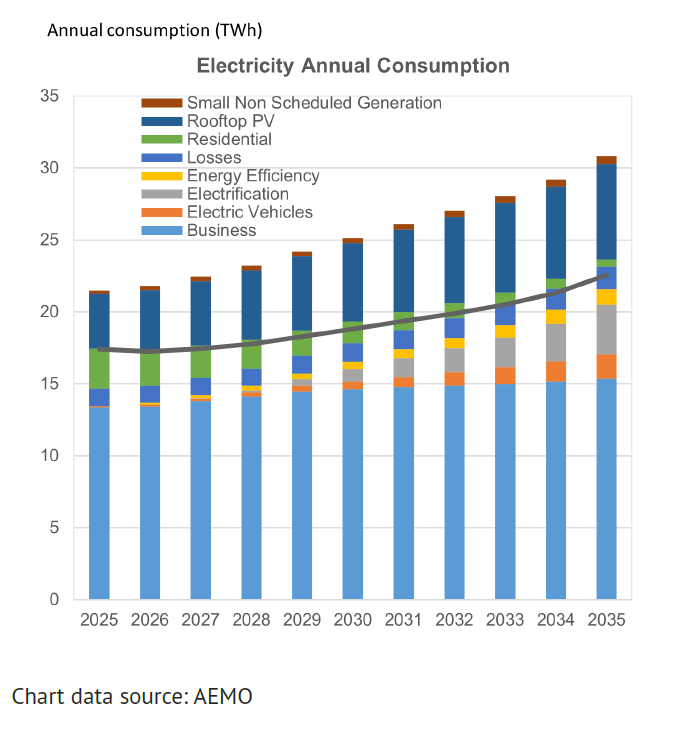

What we are seeing now is just the forefront of this transition in many markets. For example, looking at Australia, the Australian Energy Market Operator (AEMO) expects a steady increase in electricity consumption from today through to 2050, as seen in the chart here for the period 2025-2035.

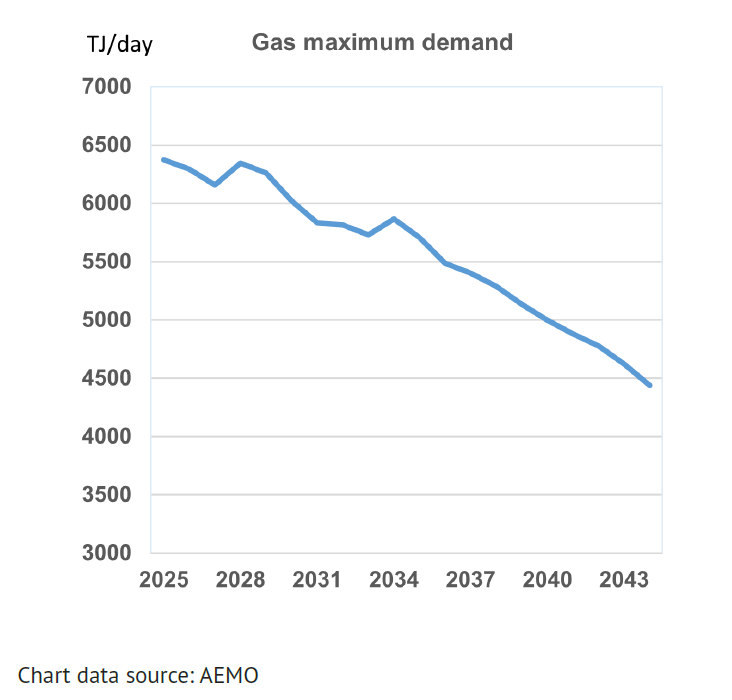

At the same time, AEMO expects consumption of fossil fuels including gas to decline. This decline is on not only an annual basis but also in terms of maximum demand; this decline is projected to sustain a downward path from 2025 to 2040 and beyond.

This implies that other energy sources, including wind and solar, are expected to be increasingly integrated into the grid to fill this gap.

There are two things that jump out here for infrastructure investors. The first is that in the near future, gas remains key in many markets to keep power generation on track. Regulation, operational provisions at systems operators and storage infrastructure (including utility-scale batteries) still need to get up the curve, to provide for a reliable and stable grid with a high level of renewables. This transition is expected to take some time. For this reason, companies including Snam (IT) and Enbridge (CA), are expected to continue to benefit from this baseload generation picture.

The second is that we can expect to see significant capital investment at transmission and distribution companies and integrated power companies as they work to accommodate a shift in the energy mix towards renewable and lower-carbon sources while demand is rising. Companies capitalising on these investment thematics include WEC Energy (US), Eversource Energy (US), Sempra (US) and National Grid (UK).

An additional, third takeaway is the sheer criticality of the electricity grid to the way we live and to how economies function. This is self-evident but worth pointing out nonetheless – we are data-driven, rely on connectivity and cannot afford disruption to the power supply. This means the regulatory environment is likely to become more complex, which will be important for all utilities companies to navigate. We see examples of this in those markets where renewables are already a high proportion of energy generation, such as Spain, where the recent blackout is prompting a review of the system.

The transition to cleaner sources of power, and electrification, is an important structural shift of our time. Fit-for-purpose infrastructure has an important role to play in this transition, with energy utilities and energy infrastructure companies an integral part of this picture to watch.

By Rebecca Hiscock-Croft

Infrastructure Investment Director

1 Data source: Australian Energy Market Operator (AEMO)

Important Information: This material has been produced by Magellan Asset Management Limited trading as MFG Asset Management ('MFG Asset Management') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an MFG Asset Management financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. MFG Asset Management makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. MFG Asset Management will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MFG Asset Management. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon.

Further information regarding any benchmark referred to herein can be found at www.mfgam.com.au/funds/benchmark-information/. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of MFG Asset Management.